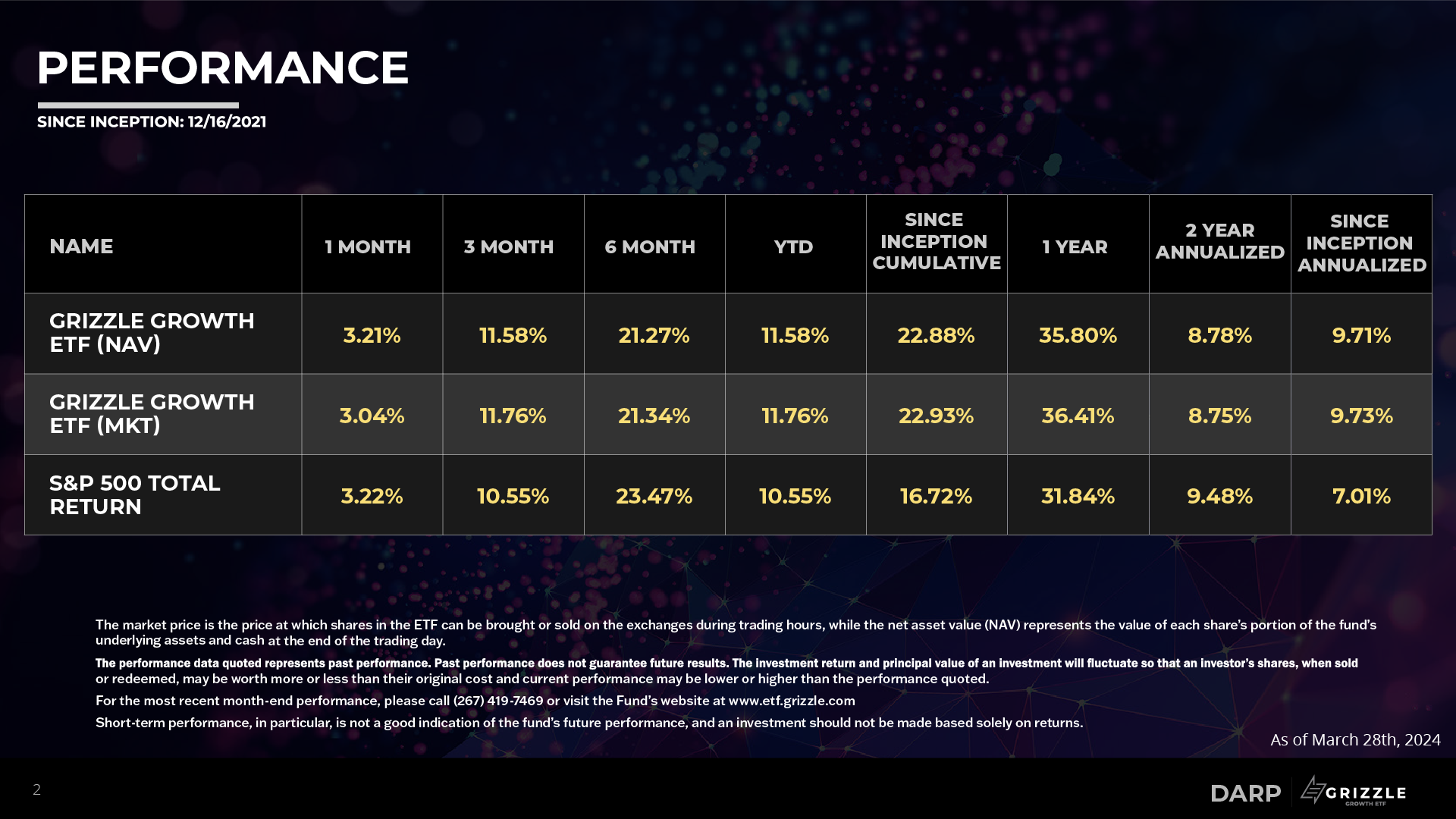

As of March 28th, 2024

WHY INVEST IN DARP?

The Grizzle Growth ETF invests in key growth themes across multiple sectors. The ETF is actively managed with a rigorous focus on investment process, portfolio construction and risk management.

Growth, Innovation & Disruption at a Reasonable Price

The DARP ETF will seek growth through innovation and disruption, targeting companies that we believe have the potential to generate attractive revenue growth and whose revenues and earnings are expected to increase at a faster rate than that of the overall market.

As of March 28th, 2024

As of March 28th, 2024

The market price is the price at which shares in the ETF can be bought or sold on the exchanges during trading hours, while the net asset value (NAV) represents the value of each share's portion of the fund's underlying assets and cash at the end of the trading day.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted.

For the most recent month-end performance, please call (267) 419-7469 or visit the Fund's website at www.etf.grizzle.com

Short-term performance, in particular, is not a good indication of the fund's future performance, and an investment should not be made based solely on returns.

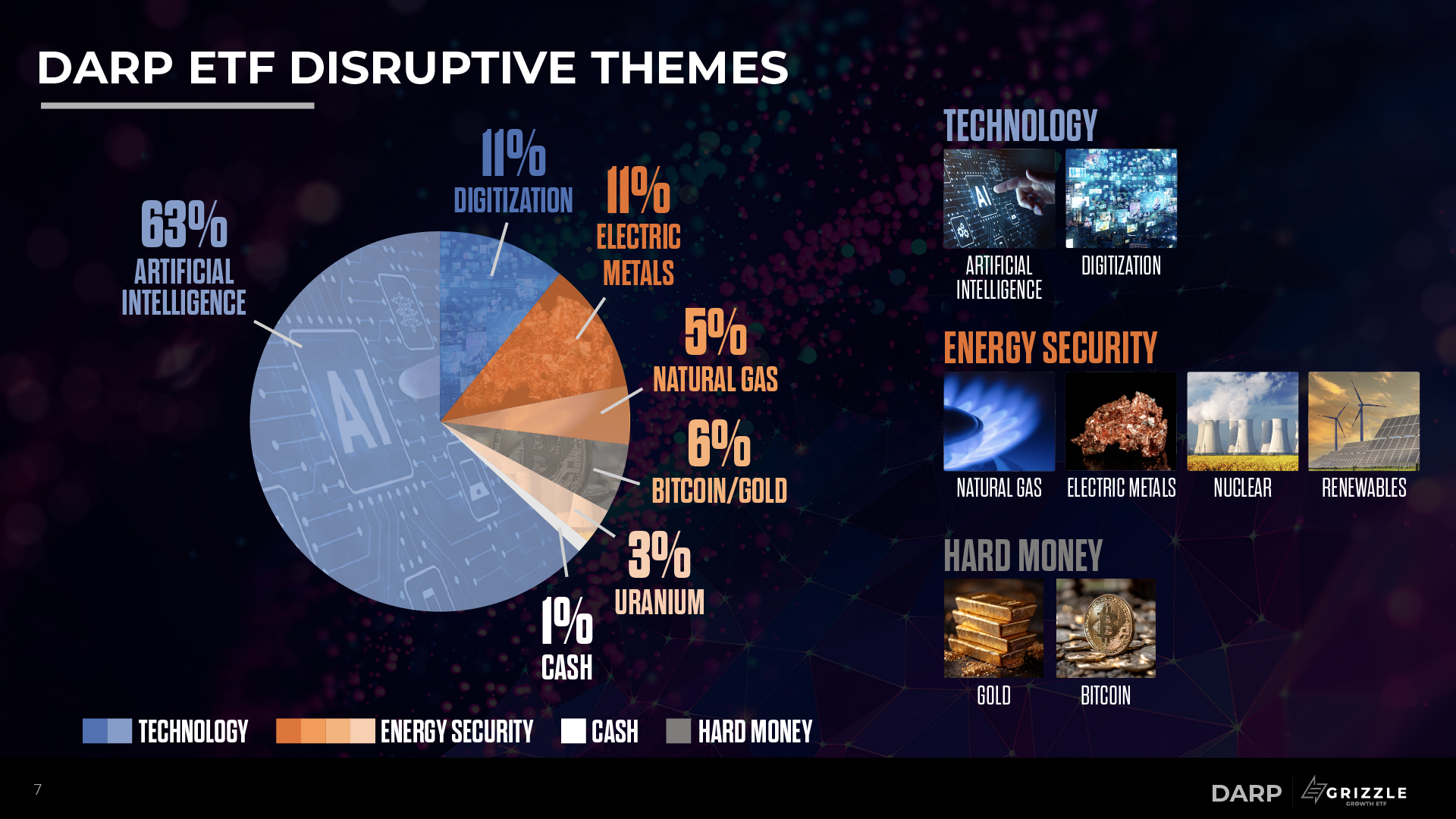

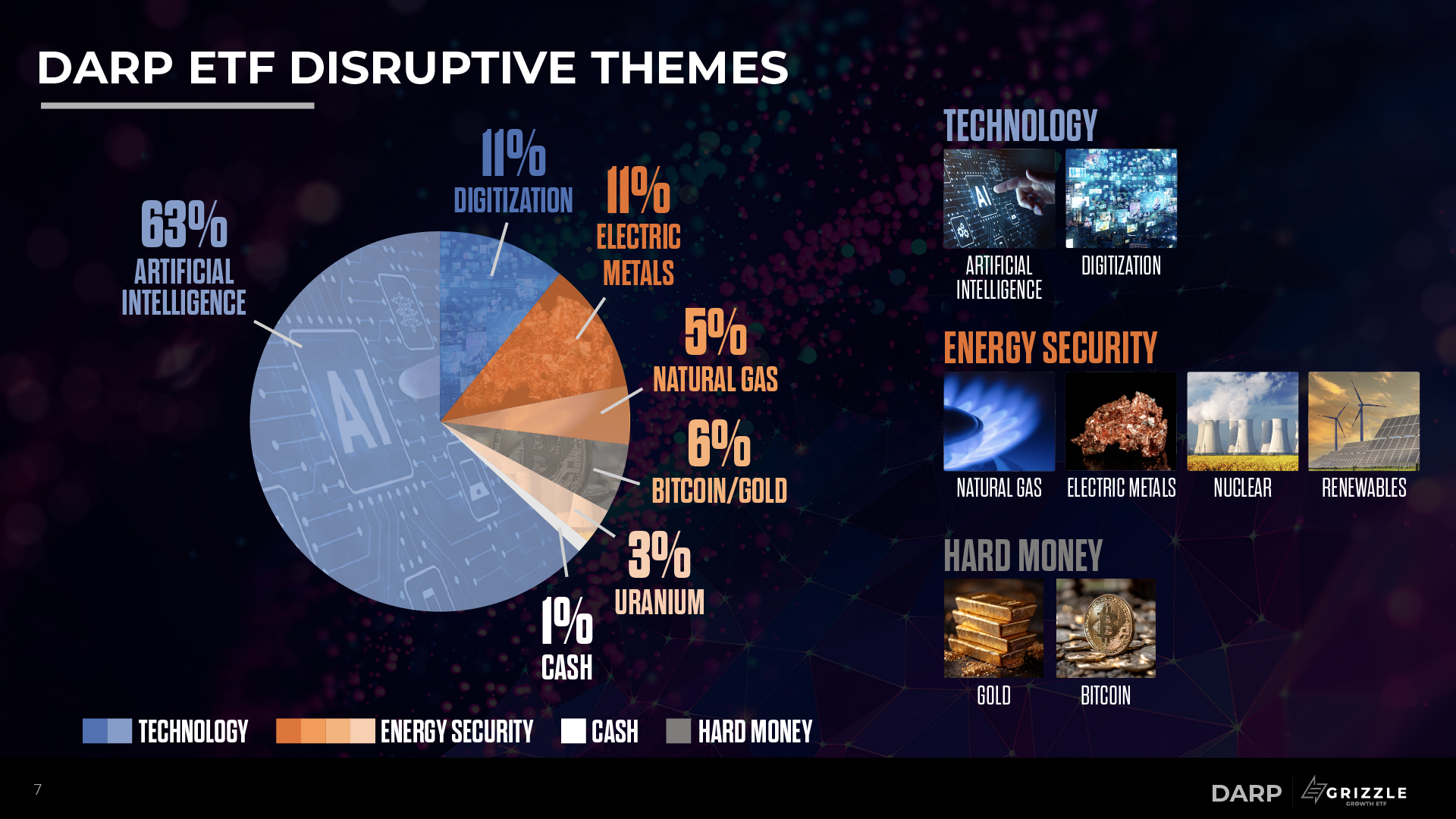

DARP is an actively managed ETF that seeks long-term capital appreciation through companies focused on growth, innovation, and disruption. The Fund seeks to identify future leaders in the following overarching key growth themes including, but not limited to: Digitization and Cloud Computing, Future Media and Entertainment, Health and Wellness, and Sustainability and Energy Transition.

The DARP ETF will seek growth, innovation and disruption at a reasonable price, targeting companies that have the potential to generate above average revenue growth and whose revenues and earnings are expected to increase at a faster rate than that of the overall economy. We focus on cashflow inflection 4-6 years in the future.

Grizzle Growth is managed by Thomas George, CFA and Scott Willis, CFA. The portfolio managers have significant institutional fund management experience in high growth and volatile asset classes such as commodities, technology, and renewables.

Both Mr. George and Mr. Willis have been featured on numerous financial programs including CNBC, Fox Business, CBC and Bloomberg. Their research has been published in major national publications such as Business Insider, The Globe and Mail, San Francisco Chronicle and Zero Hedge among others.

Thomas George, CFA

Portfolio Manager

He began his career in 2002 at TD Asset Management. He held various roles, including Head of Resource Investments, head of equity portfolio analytics research, Portfolio Manager of the TD Resource Fund, TD Energy Fund, TD Precious Metals Fund. Mr. George graduated from The University of Waterloo in 2002 with an Honors Bachelors in Environmental Engineering. He is a CFA Charterholder.

Scott Willis, CFA

Portfolio Manager

He began his career at BNY Mellon, managing portfolios for ultra-high net worth individuals. Mr. Willis later joined Credit Suisse, where he was an analyst covering the energy sector with a focus on exploration and production, refining and oilfield services. He later joined TD Asset Management, where he was a fixed income analyst covering the energy, industrials and transportation sectors. Mr. Willis graduated from Bucknell University in 2006 with a degree in Economics. He is a CFA Charterholder.

07/25/2024

As of 07/25/2024

12/17/2021

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns less than one year are not annualized. For the most recent month-end performance, please call (267) 419-7469.

Shares are bought and sold at market price (closing price), not net asset value (NAV), and are individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00pm Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns.

As of 07/29/2024

| Ticker | Name | Weight (%) | Shares | Share Price | Market Value |

|---|---|---|---|---|---|

| NVDA | NVIDIA Corp | 18.48% | 23,752 | $113.06 | $2,685,401.12 |

| MSFT | Microsoft Corp | 11.05% | 3,774 | $425.27 | $1,604,968.98 |

| AAPL | Apple Inc | 7.65% | 5,100 | $217.96 | $1,111,596.00 |

| GOOGL | Alphabet Inc | 6.19% | 5,388 | $167.00 | $899,796.00 |

| MU | Micron Technology Inc | 5.16% | 6,859 | $109.41 | $750,443.19 |

| META | Meta Platforms Inc | 4.78% | 1,492 | $465.70 | $694,824.40 |

| ASML | ASML Holding NV | 4.10% | 672 | $886.98 | $596,051.72 |

| ABNB | Airbnb Inc | 3.72% | 3,860 | $140.10 | $540,786.00 |

| TSM | Taiwan Semiconductor Manufacturing Co Ltd | 3.30% | 2,959 | $161.94 | $479,180.46 |

| AMZN | Amazon.com Inc | 3.07% | 2,448 | $182.50 | $446,760.00 |

ETF holdings and allocations are subject to change at any time and should not be interpreted as an offer of these securities.

sign up for DARP updates & investment letters

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call (267) 419-7469 or visit our website at www.etf.grizzle.com. Read the prospectus or summary prospectus carefully before investing.

A word about risk:

Investing involves risk. Principal loss is possible.

Growth Investing Risk. Growth stocks can be volatile for several reasons. Since those companies usually invest a high portion of earnings in their businesses, they may lack the dividends of value stocks that can cushion stock prices in a falling market.

Foreign Securities Risk. Investments in securities or other instruments of non-U.S. issuers involve certain risks not involved in domestic investments and may experience more rapid and extreme changes in value than investments in securities of U.S. companies.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, commodities, currencies, funds (including ETFs), interest rates or indexes.

Options Risk. The prices of options may change rapidly over time and do not necessarily move in tandem with the price of the underlying securities. Selling call options reduces the Fund's ability to profit from increases in the value of the Fund's equity portfolio, and purchasing put options may result in the Fund's loss of premiums paid in the event that the put options expire unexercised.

Emerging Markets Risk. The Fund may invest indirectly, via ADRs, in securities issued by companies domiciled or headquartered in emerging market nations.

High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the securities in its portfolio. A high portfolio turnover rate increases transaction costs, which may increase the Fund's expenses.

Models and Data Risk. When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon expose the Fund to potential risks.

Shares of the Grizzle Growth ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of the Grizzle Growth ETF shares may be at, above or below the fund's net asset value ("NAV") and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. The market price of the fund's shares may differ significantly from their NAV during periods of market volatility. Shares of the Fund may only be redeemed directly with the Fund at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Funds's shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling Fund shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns. Not FDIC Insured - No Bank Guarantee - May Lose Value

Distributed by Foreside Fund Services LLC.